Insurance Companies, Landlords and Loans… Fight Night!!

Originally Published : April 1, 2020

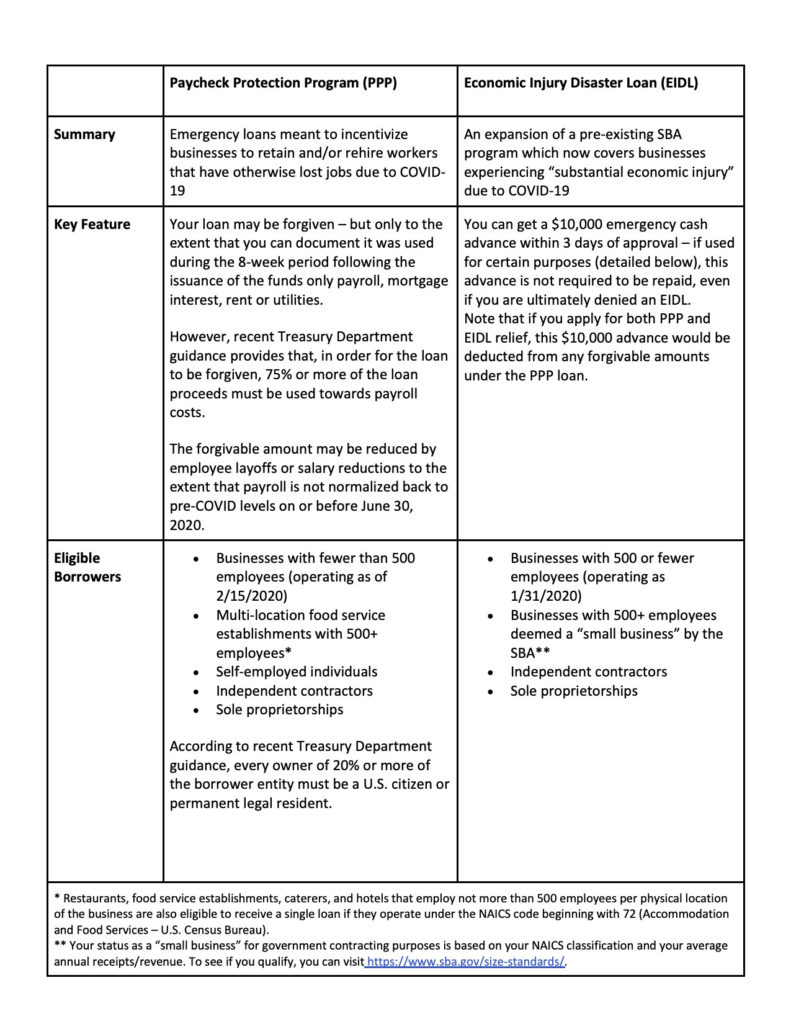

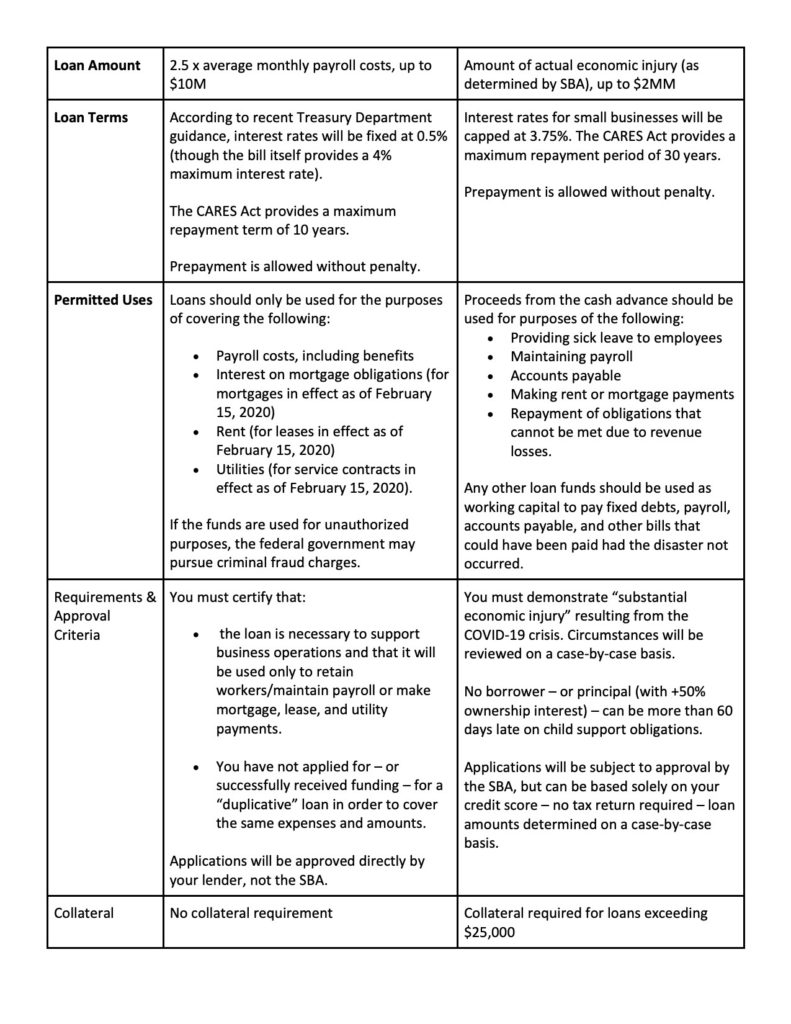

| Dear HL Clients, We all pay a huge insurance premium for our business each month and it’s always such a hard check to write because we never actually get anything for it. It’s shakedown street, but we put up with it because we think it offers us “protection” in case of a disaster and also, because we have no choice. So, when a pandemic hits and wipes out every damn business in the city, we naturally think that our insurance company would cover this right? Well, we knew right away that they wouldn’t. It’s not their nature to want to actually help despite their cutesy commercials. It’s bad for profits after all—so they hide behind semantics and exclusions—and no, they are never going to cover our business interruption (BI) claims, unless they are forced to do so. Well, today, they made it official and an HL client received a written rejection of its BI claim. Reading this smug, bullshit denial from a billion dollar insurance company had us apoplectic! So, being lawyers and all, we decided to do the only thing that makes us feel better when someone tries to bully us, our clients, or our industry; we are going to sue the insurance company! Our new, phenom litigator, Joe Taylor, is a street fighter and we are excited to see him go toe-to-toe with the big, bad insurers. Thomas Keller filed a similar claim in California and there was another in Louisiana, but now NYC is in the fray and we New Yorkers are all raging, caged up lions who do not play when our livelihoods and our lives are at stake. We will keep you posted as the case and fight progresses. On this same BI tip, a new bill was introduced in the NY State Assembly today which would require insurers providing business interruption and loss of use coverage, to cover “business interruption during a period of a declared state emergency due to the coronavirus disease 2019 (COVID-19) pandemic.”.OK, that would work. So, what’s the problem getting this to fly through the legislature and into Governor Cuomo’s heroic, presidential(?) hands so he can sign it and save the day? No clue but email your representatives in Albany and let them know you need them to support bill A. 10226. I just emailed mine and he wrote back to me. Here is what he said: ” I am a co-prime sponsor and I am actively working for the passage of this legislation”. “We have to pass the budget this week and yes, then go home. But, we are not going home for good. We will reconvene because there will be other issues and legislation needed for relief packages, etc. This legislation would be a part of that effort.” – Joe Lentol, Assemblyman Find your rep here: https://nyassembly.gov/mem/ Moving on to the wild world of NYC real estate. Lot’s of you have hired us to help you deal with your landlords. We have engaged with many of them and below is an update to the current conditions: Landlord Encounters by Mayan Bouskila, RE Chair We have been engaging with various landlords and are seeing them take different approaches to weathering the disruption and dealing with the knowledge that very little rent will be coming in from their restaurant and retail tenants: Some landlords are open to deferring rent for the next 2-3 months;Some landlords are open to paying rent from your security deposit and such amount to replenished at a later agreed time; Some landlords are open to offering reduced rent and the balance to be paid at a later agreed time. With rent for April due tomorrow, we remind clients to reach out to your landlords and agree a solution for the next few months. This should be documented by way of amendment to lease, and signed in writing by both parties to ensure your rights are protected and the failure to pay timely rent isn’t a default under the lease. If you have any questions about your lease or how to deal with your landlord, contact Mayan at: [email protected] The CARES Act Remember that the federal CARES Act creates 6 separate initiatives, some of which we’ve covered in previous issues. Tonight, we want to focus on the two financing options available: Paycheck Protection Program (PPP) and the Economic Injury Disaster Loan (EIDL). (SEE IMAGES BELOW) Can I apply for both the PPP and the EIDL?Y es. However, you cannot apply for both loans if you are planning to use the loan proceeds for the same purpose. Said differently, you cannot double-dip for the same type of cost (e.g., rent, payroll, etc.). If the funds are used for different businesses expenses, not for duplicative purposes, you may apply — and be approved — for both loans. So for example, if you apply for the PPP and the EIDL, you may use the EIDL proceeds to pay vendors, and the PPP proceeds to pay payroll costs. What if I’m approved for an EIDL – or the $10,000 advance – and then approved for a PPP? The outstanding amount of an EIDL may be refinanced into a Paycheck Protection Program loan. In addition, any emergency EIDL advance received by a borrower who subsequently receives a PPP loan will be subtracted from the calculation of the loan forgiveness amount referenced above. How do I know which one is right for me? A few key considerations include the following: spending discretion, immediacy, and the length of time for repayment.Spending Discretion. A PPP loan can only be used to pay payroll, rent, and utility expenses (and interest, but not principal, on existing debt), whereas EIDL proceeds can be spent on a much broader category of expenses, including the repayment of obligations that cannot be met due to revenue loss. Immediacy. If you choose to apply for an EIDL, you could have quick access to $10,000 — the advance would be available within three days of your application, with no requirement to repay any amount of it back, even if your application is subsequently denied the EIDL grant.Then, if necessary, you can always apply for a PPP loan and roll the EIDL loan into that application. If an applicant receives an advance under the CARES Act but is approved for a PPP loan instead, the advance amount is reduced from the amount of the loan eligible for forgiveness under the PPP program. What about those other initiatives from the CARES Act that are designed to help me out? An employer who receives a PPP loan is ineligible for the employee retention credit under the CARES Act. And if your PPP loans are forgiven, you are not eligible for deferral of payroll taxes as otherwise permitted under the CARES What are employee retention credits? The CARES Act allows tax credits to employers that have seen their operations shuttered or partially shuttered because of COVID-19.The credits can go as high as 50% of qualified wages paid to an employee between March 13, 2020, and the end of the year. These credits max out at $10,000 per employee. They also apply only to employment taxes, such as FICA, federal unemployment taxes, and Social Security taxes. And they cannot be taken alongside other coronavirus-related benefits, such as credits for paid leave under the FFCRA or Paycheck Protection loans. Qualifying employers with 100 employees or fewer can take a credit for all qualifying wages. What about payroll tax deferrals? Employers are able to defer Social Security taxes. Any deferred payment would need to be paid over the next two years, with half due by December 31, 2021, and the rest due by December 31, 2022. PAID LEAVE & REQUIRED POSTERS NEW RULES EFFECTIVE TOMORROW, APRIL 1, 2020 The Families First Coronavirus Response Act (“FFCRA”) can give you access to immediate tax relief as a method to pay for their employee’s leave and other time off. In short, the FFCRA created two new paid-leave programs, one that provides paid emergency sick leave, up to two weeks’ worth. The other address emergency family and medical leave which provides for up to 12 weeks of unpaid time off. There was much debate over the last two weeks as to whether employers would need to upfront the leave and be paid back eventually through a series of tax rebates and credits; but we are happy to report that employers can receive advance tax credits immediately, if the monies are used to pay for employee leave. Beyond this basic framework, it is not yet clear how the credits will be implemented. We expect this guidance to be provided at literally any moment and will update you with that new information. Regardless, in general, because the FFCRA (and other post-COVID-19 programs) are new and novel, new questions about interpretation and compliance are raised everyday. You must consult with legal counsel to understand the different loans under the Act’s various new programs. It is crucial that you understand the programs’ rules and requirements before committing to any particular loan. NEW POSTER REQUIREMENT However, there is one requirement that we are sure of—if you are open and operating, in any capacity—you must provide a FFCFRA Notice to your employees immediately. You do not have to provide the notice to your former employees or to new employees. You are only required to post the poster in a conspicuous place or by emailing or directly mailing this notice to employees; or posting this notice on an employee information internal or external website. Even if you have other posters posted (New York State or New York City rules), this is a new requirement and must be added. THIS POSTER MUST BE POSTED BY APRIL 1, 2020 To obtain a PDF copy of this required poster in both English and Spanish, please click here, to fill out the form. Again, encourage you to share this resource with your friends, peers and colleagues in our industry. Here is the full link: https://forms.gle/F9n1EPT947kD8nh99, to share. While the federal Department of Labor has placed the date of posting to be completed on or before April 1, 2020, the DOL has made it clear that it will be withholding enforcement actions for a short period of time to allow time for employers to come into compliance. Let us cross this off the list for you now. Please fill out the form to obtain your copies of this form in English and Spanish. An hour ’til Rachel. See you tomorrow. Take care, David |